WASHINTON DC (April 24, 2020) — The novel coronavirus (COVID) pandemic and resulting economic crisis has been met with an unprecedented policy response. Through legislative, administrative, and Federal Reserve actions, policymakers are currently working to pour trillions of dollars into the economy. COVID Money Tracker is a new initiative of the Committee for a Responsible Federal Budget focused on identifying these dollars and tracking their disbursement. The project will ultimately feature a state-of-the-art interactive database similar to Stimulus.org, where we tracked stimulus, financial rescue, and extraordinary Federal Reserve measures enacted in response to the 2008 financial crisis.

COVID Money Tracker will ultimately track every major action taken by Congress, the Federal Reserve, the executive branch, and various federal agencies, following how much is disbursed over time, where the funds go, and how much is recovered through loan repayments, dividends, or equity repurchases.

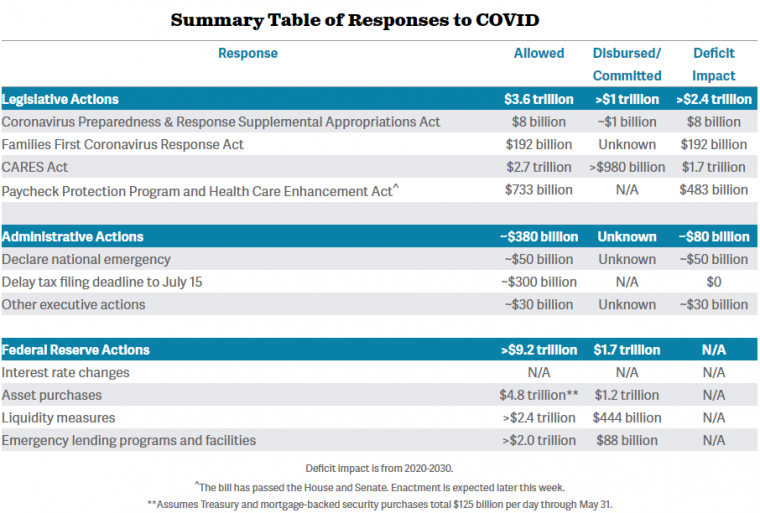

In this analysis, we show the actions taken so far and the status of those actions where possible. So far, enacted (and soon-to-be enacted) legislation has authorized roughly $3.6 trillion of fiscal support, which will ultimately add around $2.4 trillion to the deficit. At least $1 trillion of those funds have already been disbursed or committed. Meanwhile, administrative actions from the President are likely to cost another $80 billion. In addition, the Federal Reserve has already undertaken at least $1.9 trillion of loans, asset purchases, and other activities and has announced plans that could total as much as $9 trillion of actions through the end of May.

The tables below offer more detail on the actions taken to date. We will continue to track these actions and follow the money as it is disbursed at www.COVIDMoneyTracker.org.

Legislative Actions

In March 2020, Congress enacted three pieces of legislation related to the current pandemic and economic crisis. In total, these bills will allow roughly $2.9 trillion of spending, tax-cuts and tax-deferrals, loans, and other measures. Based on scores from the Congressional Budget Office (CBO), these bills will add about $2 trillion to the deficit, on net, over the next decade. So far, we have identified $840 billion that has been disbursed or committed, though only some of that has been actually disbursed so far, and this number does not capture programs that have no publicly available data or announcements about disbursements. A fourth bill, the Paycheck Protection Program and Health Care Enhancement Act, is currently being debated in Congress and is likely to be signed by the President this week and would add $483 billion to the deficit, per the CBO.

The first bill, the Coronavirus Preparedness and Response Supplemental Appropriations Act, authorized $8.3 billion in emergency funding to help mitigate the coronavirus outbreak. The emergency appropriations in this bill were directed toward the immediate health response to the virus, including increased funding for vaccine development, health preparedness, Community Health Centers, and overseas efforts to combat the outbreak.

The second bill, The Families First Coronavirus Response Act, established a new tax-credit for COVID-related sick leave; increased federal support for existing automatic stabilizers; waived Medicare, Medicaid, and Children's Health Insurance Program (CHIP) cost-sharing for COVID-related treatment; and approved more funding for agencies to spend on COVID-related needs. CBO estimates the bill will increase deficits by $192 billion over ten years.

The third bill, The Coronavirus Aid, Relief, and Economic Security (CARES) Act, included one-time direct payments to households, an expansion of unemployment benefits, forgivable loans to small businesses, support for new Federal Reserve lending facilities, additional federally-backed loans and grants to businesses, expansions of safety-net programs, tax-breaks, and increased federal support for individuals and businesses, funding for health providers, grants to states, and a variety of other changes. The CARES Act authorized roughly $2.7 trillion of fiscal support, which CBO estimates will ultimately add $1.8 trillion to the deficit.

The fourth bill, The Paycheck Protection Program and Health Care Enhancement Act, mostly builds on programs established in the CARES Act, appropriating $321 billion more for the small business Paycheck Protection Program (PPP), increasing funding for Emergency Injury Disaster loans and grants by $60 billion, and adding $100 billion to the Public Health and Social Services Emergency Fund. The bill provides roughly $733 billion in fiscal support, which per CBO estimates will add $483 billion to the deficit.

More details on these bills is available in the appendix of this piece and in our previews pieces on the CPRSA, FFCRA, CARES Act, and the Paycheck Protection Program and Health Care Enhancement Act.

Legislative Responses

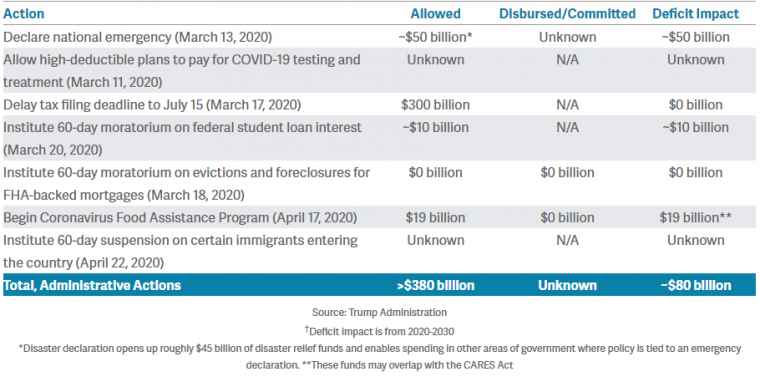

Administrative Actions

In addition to Congress, the Trump Administration has taken actions aimed at ameliorating the economic and health effects of the COVID pandemic. These actions include freeing up disaster relief funds, delaying tax filing, instituting 60-day moratoriums on student loan interest payments and Federal Housing Administration (FHA) borrower evictions and foreclosures, allowing high-deductible plans to cover coronavirus costs, and making direct payments to farmers and ranchers with losses. We estimate these policies will provide at least $380 billion of near-term support and liquidity into the economy and ultimately cost about $80 billion.

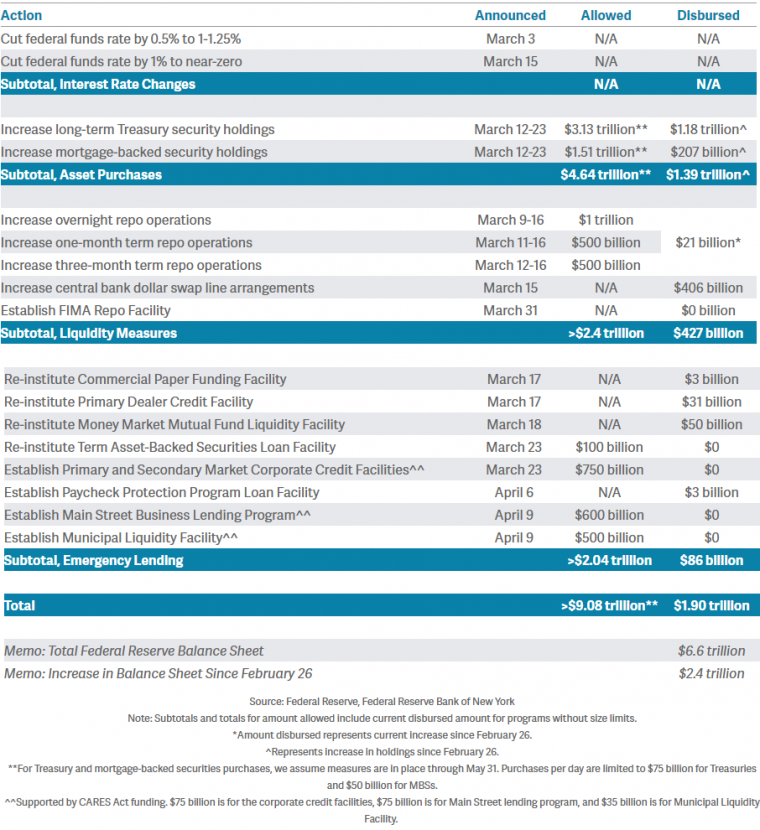

Federal Reserve Actions

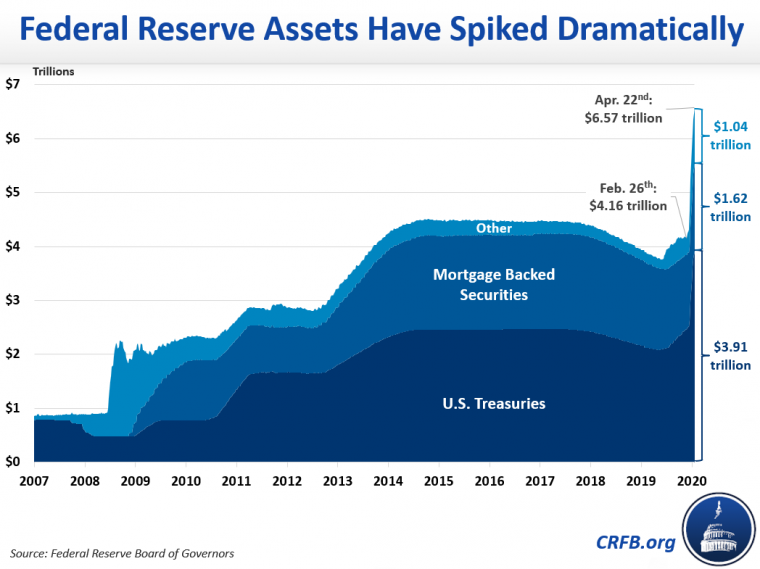

The Federal Reserve has taken a number of actions since the pandemic began to promote economic and financial stability, inject liquidity into the economy, and extend available credit. Specifically, the Federal Reserve has reduced interest rates, expanded asset purchases, engaged in liquidity measures, and offered emergency lending. On net, we estimate these measures total $1.7 trillion in economic support so far – including $1.2 trillion from expanding its holdings of Treasuries and mortgage-backed securities. The total measures the Federal Reserve has announced it will allow itself to undertake could total as much as $9.2 trillion, or potentially more, if continued at current purchase limits through May 31. Federal Reserve actions have no direct impact of the federal budget deficit.

Among the measures the Federal Reserve has or will undertake includes the purchase of Treasuries and mortgage-backed securities; expanded repo and dollar swap operations; the revival of emergency lending facilities from the Great Recession for money market mutual funds, commercial paper, primary dealer financial institutions, and asset-backed securities; and new lending facilities creates with support of the CARES Act to support corporate credit, small business loans, and municipal bonds. The Federal Reserve has also agreed to buy forgivable bank loans offered to small businesses under the Paycheck Projection Program.

In total, the Federal Reserve balance sheet has expanded by $2.4 trillion since February 26 — from $4.2 trillion to $6.6 trillion — and the balance sheet is likely to expand by trillions more over the course of the crisis.

Together, these measures will provide a substantial amount of financial support for the economy. The COVID Money Tracker will track these programs dollars are disbursed and in some cases repaid, while also monitoring further executive, legislative, and Federal Reserve action. Visit www.COVIDMoneyTracker.org regularly for more information.

Appendix - Details on Actions Taken

Below are more detailed summaries of each of the actions taken by Congress, the White House, and the Federal Reserve.

Congressional Legislation

Coronavirus Preparedness and Response Supplemental Appropriations Act (HR6074)The first legislative COVID response was an emergency appropriations bill that was signed into law in early March. The bill includes about $3.1 billion for research and development for COVID vaccines and other treatments, about $3.2 billion for health care preparedness and supplies to the Centers for Disease Control and Prevention (CDC) and other health care entities, $1.2 billion to the State Department to support embassies and provide humanitarian aid and other assistance to other countries, and small amounts of funding for the Food and Drug Administration (FDA) and the Small Business Administration. The bill also waives certain restrictions on telehealth in the Medicare program in emergency areas (now the whole country), allowing more Medicare enrollees to have doctor's visits done remotely.

CBO estimates the bill will cost $8.1 billion over ten years, with $7.6 billion coming from emergency appropriations and $490 million coming from the telehealth changes.

The House and Senate passed the bill nearly unanimously on March 4 and March 5, respectively, and President Trump signed it into law on March 6.

Families First Coronavirus Response Act (HR6201)The second legislative response contained broader public health and economic measures in a bill negotiated by House Democrats and the Trump administration. Most notably, the bill requires public and private employers with fewer than 500 employees to provide emergency sick leave to employees during a public health emergency. Specifically, it requires those businesses for the rest of 2020 to offer employees who have to stay home with a child ten days of unpaid sick leave, then paid leave at two-thirds of an employee's pay for another ten weeks, limited to $200 per day and $10,000 total. It also requires two weeks of paid sick leave for anyone specifically affected by COVID at two-thirds pay. Businesses will be reimbursed for the cost of sick leave through payroll-tax credits.

Other policies include increasing the Medicaid matching rate to states and Medicaid funding for territories; requiring all insurance to cover COVID testing without cost-sharing and appropriating $1 billion to reimburse tests for the uninsured; expanding Supplemental Nutrition Assistance Program (SNAP) benefits by waiving work requirements and allowing states to increase benefits to the maximum allotment; fully federally funding a second 26-week period of unemployment benefits that is usually half state-funded; and increasing funding for the Special Supplemental Nutrition Program for Women, Infants, and Children (WIC), senior meal delivery, and food banks.

CBO estimates the bill will cost $192 billion over ten years. The majority of the cost ($105 billion) is for the paid leave provisions, with other costs coming from the Medicaid funding ($50 billion), SNAP expansion ($21 billion), free testing requirement ($10 billion), unemployment benefit funding ($5 billion), and nutrition program funding ($1 billion).

The House passed the bill by an overwhelming majority on March 14, and the Senate did the same on March 18. President Trump signed it into law on March 18.

Coronavirus Aid, Relief, and Economic Security (CARES) Act (H.R. 748)The third legislative response largely focuses on economic relief for households and businesses but also additional funding for health measures. The bill includes $269 billion for an expansion of unemployment benefits to increase the benefit size, the number of weeks it is available for, and the people who qualify beyond just employees. It also provides rebates of $1,200 per adult and $500 per child to people making less than $75,000 and couples making less than $150,000, costing $293 billion. State and local governments will get $150 billion of general funding (at least $1.25 billion per state) and another $30 billion for to cover education spending, while college students are able to receive student aid that was interrupted by the pandemic and get a six-month moratorium on student loan payments, costing $9 billion. In addition, the bill increases safety-net spending on nutrition, family services, and housing by $42 billion and includes several small tax cuts for individuals totaling $10 billion.

For businesses, there is $377 billion of funding for small businesses, with almost that entire amount going to Paycheck Protection Program loans that will be forgiven to the extent they went toward basic expenses; emergency grants to businesses take up the small remainder. In addition, the bill authorizes $510 billion of loans for big businesses and governments, with $55 billion set aside for airlines, firms vital to national security, the postal service, and $454 billion to support Federal Reserve lending-facilities to provide $4.5 trillion of credit to other businesses and state and local governments. The bill also includes $280 billion of tax-cuts, mostly for temporarily loosening caps on net operating-loss and interest deductions, but also by providing a payroll-tax credit to businesses who maintain payroll and by delaying payment of 2020 employer-payroll taxes until the following two years.

The bill contains $180 billion of health-related spending, including $100 billion of hospital funding, about $35 billion of preparedness and response funding across several agencies, $20 billion of funding for veterans and defense health programs, about $20 billion to expand Medicare provider payments and benefits and expand telehealth and home health services, and about $5 billion to fund community health centers. In addition, the bill appropriates $45 billion for the disaster relief fund that the March 13 emergency declaration opened up.

CBO estimates the bill will cost around $1.7 trillion through 2030. The main difference between CBO's score and the numbers above is that the $510 billion of loans for businesses and municipal governments will have very little actual cost. CBO estimates there will be zero net costs from the Fed lending facilities and only a $1 billion net cost from lending to airlines and businesses vital to national security. Combined with the $10 billion of additional borrowing authority for the postal service, this section of the bill will have a net cost of $11 billion.

The Senate unanimously approved the bill on March 25, and the House passed it by voice vote on March 27. President Trump signed it into law on March 27.

Paycheck Protection Program and Health Care Enhancement Act (H.R. 266)The fourth legislative response, dubbed "phase 3.5" increases funding for The Paycheck Protection Program (PPP) established under The CARES Act; the program exhausted its initial appropriation of $349 billion last week. The bill substantially increases funding for the program from $349 billion to $670 billion — a $321 billion increase ($310 million available in loans). Of the $310 billion available in loans, $60 billion are to be made by small banks, community financial institutions, and credit unions with under $50 billion in consolidated assets.

The bill appropriates an additional $50 billion for The Economic Injury Disaster Loan (EIDL) program, which is estimated to support around $300 billion in loans. The bill also boosts funding for the EIDL grant program by $10 billion, which offers a $10,000 cash advance to help struggling business owners affected by the nationwide economic lockdowns. The Small Business Administration (SBA) will also receive $2.1 billion in additional funding to support their operational capacity.

The bill also provides an additional $75 billion in funding for health providers to prepare and respond to the COVID-19 outbreak, and $25 billion for Coronavirus testing. Of the $25 billon allocated for testing, $11 billion is earmarked for states, localities, territories, and tribal communities.

While the bill provides around $733 billion in fiscal support into the economy through the increased lending capacity of the EIDL program, CBO estimates the bill will cost $483 billion over ten years.

The Senate passed the bill by unanimous consent on April 21, and the House passed it 388-5 on April 23. President Trump is expected to sign later this week.

Administrative Actions

Declare a National EmergencyPresident Trump declared a national emergency on March 13. This declaration allows the Department of Health and Human Services (HHS) to waive nationally certain restrictions in public insurance programs it governs (including the telehealth restrictions that are allowed to be waived in emergency areas in the first response bill). It also frees up a $50 billion Disaster Relief Fund to be spent. There is no cost estimate for waiving the restrictions, and the amount spent from the relief fund depends on how it is deployed.

Allow High-Deductible Plans to Pay for COVID Testing and TreatmentIn addition, the Internal Revenue Service (IRS) announced on March 11 that high-deductible insurance plans can cover COVID tests and treatment without jeopardizing their tax status. This policy interacts with the second response bill's provision requiring no cost-sharing for COVID tests and potential future policies requiring no cost-sharing for treatment.

Delay the Tax Filing DeadlineTreasury Secretary Steve Mnuchin announced on March 17 that tax-filers are able to file up to 90 days beyond the April 15 deadline without penalty, affecting an estimated $300 billion of tax payments. Payments of up to $1 million for individuals and $10 million for businesses can be deferred until July 15. On March 20, Sec Mnuchin announced that the filing deadline in general will be moved back to July 15. This policy will have almost no cost other than a small amount of interest costs associated with the delay since only the timing of the payments will be affected.

Institute a Moratorium on Federal Student Loan InterestOn March 13, President Trump announced that the Department of Education will waive interest on federal student loans during the COVID emergency. This move will not necessarily change the monthly payments that borrowers owe, but it would enable them to pay down their balances more quickly. The Education Department followed up with a release on March 20 stating that interest rates will be set to zero and student-loan payments will be suspended for at least the next 60 days. This policy was superseded by The CARES Act, which suspends student loan payments and interest accrual for six months.

Institute a Moratorium on Evictions and Foreclosures for FHA-Backed MortgagesOn March 18, The Department of Housing and Urban Development (HUD) announced a 60-day moratorium on evictions and foreclosures in properties with federally-backed mortgages. This policy will have little cost since it is temporary and does not affect monthly payments. This policy was superseded in The CARES Act, which also allowed those with federally-backed mortgages to request mortgage forbearance for up to six months with the possibility of an extension for another six months.

Federal Reserve Actions

Cut the Federal Funds RateIn two different moves, The Federal Reserve reduced the federal funds rate to near zero as it was for years following the Great Recession. The Federal Open Market Committee (FOMC) first lowered the rate from 1.5-1.75 percent to 1-1.25 percent on March 3, then lowered it further to 0-0.25 percent on March 15.

Increase Long-Term Treasury Security HoldingsOn March 12, the Fed announced the purchase of $60 billion of Treasury securities over the next month. On March 15, along with cutting the fed funds rate to near zero, the FOMC announced the purchase of $500 billion of Treasury securities, as well as the reinvestment of principal back into those securities. On March 23, the Fed announced that the security purchases would increase to be as large as needed to support market functioning, and the New York Fed stated the same day that it planned to purchase $75 billion of Treasury securities per day.

These are the first major Fed increases in these holdings since a round of quantitative easing that ran from 2012 through 2014.

Increase Mortgage-Backed Security HoldingsIn addition to purchasing long-term Treasury securities, the Fed started purchasing mortgage-backed securities as it did following the Great Recession. On March 15, the FOMC announced the purchase of $200 billion of mortgage-backed securities. On March 23, the Fed announced that the security purchases would increase to be as large as needed to support market functioning and that the purchases would also involve commercial mortgage-backed securities. The New York Fed stated the same day that it planned to purchase $50 billion of mortgage-backed securities per day.

These are the first major Fed increases in these holdings since a round of quantitative easing that ran from 2012 through 2014.

Increase Overnight Repo OperationsThe Fed uses repurchase agreements, or repos, to stabilize short-term funding for financial institutions through short-term collateralized loans. The Fed had instituted repo operations in September 2019 to address market turmoil at the time. On March 9, the Fed increased its daily overnight repo operations, where loans last for one day, from $100 to $150 billion. On March 11, the Fed again increased its daily overnight repo operations to $175 billion and instituted three one-month term repo operations of $50 billion each. On March 16, the Fed announced an additional $500 billion of overnight repos to be conducted that day, which were extended the next day to twice-daily operations through March 20. On March 20, it extended the $500 billion of twice-daily overnight repos through April 13, and on April 13, the New York Fed announced an extension through May 4. After that date, the Fed plans to pare down operations to be held daily rather than twice per day.

Notably, the numbers above and in subsequent repo operations sections represent upper limits on repo operations. Actual take-up has been substantially less than these limits and declined significantly after mid-March.

Conduct One-Month Term Repo OperationsIn addition to increasing overnight repo operations, the Fed has instituted one-month term operations. On March 11, it announced it would hold three one-month operations of $50 billion each. The following day, it established another $500 billion one-month operation and stated that it would hold weekly one-month operations of $500 billion each through April 13. on April 13, the New York Fed announced an extension of weekly operations through May 4, after which operations would be held every other week rather than weekly.

Conduct Three-Month Term Repo OperationsThe Fed has also conducted three-month term operations. On March 12, the Fed announced two $500 billion three-month operations and weekly three-month operations of $500 billion each through April 13. The weekly operations were extended on April 13 through May 4, after which operations would be held every other week rather than weekly.

Support U.S. Dollar Liquidity AbroadOn March 15, the Fed announced coordinated action with four other central banks who already conduct regular U.S. dollar operations that they would expand swap line arrangements to enhance dollar liquidity. These swap lines were also On March 31, it announced the establishment of a FIMA Repo Facility, which would undertake repos with foreign central banks' Treasury security holdings to support U.S. dollar liquidity abroad and smooth the functioning of the Treasury market.

Re-Institute Commercial Paper Funding FacilityOn March 17, the Fed re-instituted The Commercial Paper Funding Facility (CPFF), which was originally created in 2008 during the financial crisis. The facility supports the commercial paper market that provides short-term financing for companies. There is no specific limit on the size of the facility.

Re-Institute Primary Dealer Credit FacilityOn March 17, the Fed re-instituted the Primary Dealer Credit Facility (PDCF), another facility originally created in 2008 that backstops financial institutions who help the Fed implement its monetary policy. There is no specific limit on the size of the facility.

Re-Institute Money Market Mutual Fund Liquidity FacilityOn March 18, the Fed re-instituted The Money Market Mutual Fund Liquidity Facility (MMLF), another facility that was originally created in 2008, with the purpose of backstopping money market funds. There is no specific limit on the size of the facility.

Re-Institute Term Asset-Backed Securities Loan FacilityOn March 23, the Fed re-instituted The Term Asset-Backed Securities Loan Facility (TALF), another major part of the Fed's 2008 response to backstop the issuance of asset-backed securities. It later stated that TALF would support up to $100 billion of loans.

Establish Primary and Secondary Market Corporate Credit FacilitiesIn addition to re-instituting several Great Recession-era lending facilities, the Fed established two new facilities on March 23: The Primary Market Corporate Credit Facility (PMCCF) and The Secondary Market Corporate Credit Facility (SMCCF). The primary market facility was formed to backstop new corporate bond and loan issuance while the secondary market facility was formed to provide liquidity for existing corporate bonds. The facility will begin functioning on April 6 and will run for six months. The Fed later stated that the two facilities would support up to $750 billion of loans, with $75 billion of equity coming from CARES Act funding.

Establish Municipal Liquidity FacilityOn April 9, the Fed announced a Municipal Liquidity Facility (MLF) to purchase up $500 billion of short-term bonds from states, counties with more than 2 million people, and cities with more than 1 million people. The facility would get $35 billion of credit protection from The CARES Act funding for Fed facilities to support lending to large businesses and municipal governments.

Establish Main Street Business Lending ProgramOn March 23, the Fed announced that it would establish a Main Street Business Lending Program to support lending to small and medium-sized businesses, "complementing efforts by the SBA." On April 9, it providedfurther details on the program, stating that it would purchase 95 percent of loans from banks to businesses with fewer than 10,000 employees or $2.5 billion in annual revenue up to $600 billion in total loans. The program would be backed with $75 billion of CARES Act funding.

Establish Paycheck Protection Program Loan FacilityOn April 6, it announced that it would establish a Paycheck Protection Program Loan Facility to backstop loans issued through The Paycheck Protection Program (PPP) established in the CARES Act. There is no limit established for the facility, though it would presumably be limited to the size of PPP itself.